Following a rebound in student numbers and accommodation demand post-Covid, and as we come to the end of the 2022/23 university year, we caught up with Senior Surveyor, Ollie Deme for his views on what the future holds for student investment.

“For the three years pre-Covid, applications averaged 560,000 per annum. Post Covid there has been a strong recovery following an initial drop, with over 600,000 applicants on average from 2021-23. UCAS has predicted that there will be over 1 million university applications by 2030.

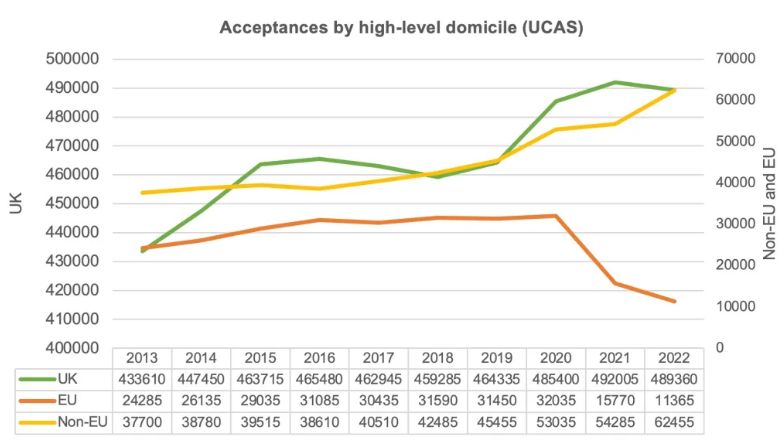

“Whilst we have observed growth in both UK and international student numbers, recently this is most noticeable within non-EU students. For example, in Canterbury, where we are providing advice to existing owners, 2022 saw a 23% increase in placed applicants from China and a 7.6% increase from India which more than offsets a fall in EU students since Brexit.

“A fall in pipeline supply, on top of 43% of higher education institutions having an overall shortage of accommodation in September 2022, according to a poll of College and University Business Officers (CUBO), combined with a continued rise in student numbers, bodes well overall for rental growth.

Unite and Empiric are projecting rental growth of around 7%, with growth during 2022 of 3.5% and 5.2% respectively. Coupled with this, the noticeable increase in non-EU overseas students, who pay the highest fee rates and often demand the highest quality accommodation, we anticipate will further drive rental growth.

“Whilst PSBA (Purpose Built Student Accommodation) is attracting much of the mainstream airtime, according to StuRents, over 70% of student accommodation outside of university-owned buildings continue to be in the form of Houses in Multiple Occupation (HMO). However, issues with this remain for private landlords, including increased CapEx expectations to comply with ESG regulation and continued problems following structural regulatory and tax changes, with over 300,000 buy-to-let mortgages redeemed since 2017 and a drop of almost a third in large HMOs from pre-pandemic to now. Institutional demand for living sector investment is also driving a growing number of PBSA assets, with Article 4 Directions growing in number there will likely be continued drops in HMO numbers, further accelerating growth therefore within PBSA.

“Build price inflation, particularly since March 2020, has seen pressure placed firmly on developers, restricting PBSA development to some extent. However, forecasting has evolved rapidly with increased confidence in build price inflation predictions. The latest BCIS forecasts are for build cost inflation to fall back to 2-3%, which will likely result in increased viability of PBSA development and more manageable cost predictions throughout a development cycle. With the growing number of overseas students highlighted above, their preference for high-quality new build accommodation will likely continue to drive PBSA development.

“The sector isn’t without its short-term challenges, with inflationary pressures on operating costs, ESG strategies and other regulatory issues, combined with relatively high-interest rates and challenges in the debt market which have cooled investment market activity. However, within the short-term environment, existing student accommodation stands to benefit from the reduced future supply, which is curtailed by more stringent planning requirements such as the inclusion of affordable housing contributions, high-rise fire safety compliance, the price of land and increased construction costs, which have raised the minimum rental levels needed to make schemes viable.

“In the medium and long term, the fundamentals of the student investment market remain strong, particularly for PBSA. The underlying occupier demand is resilient, with a growing number of non-EU students, who are part of the rental growth driver, alongside falling HMO numbers and the weight of capital coming into living markets. In anticipation of confidence returning to the capital markets as the year progresses, combined with a peaking of short-term interest rates and reducing inflation, the student accommodation market stands to attract strengthened investor appetite.”

Click here to find out more about our commercial investment consultancy services.