Project summary

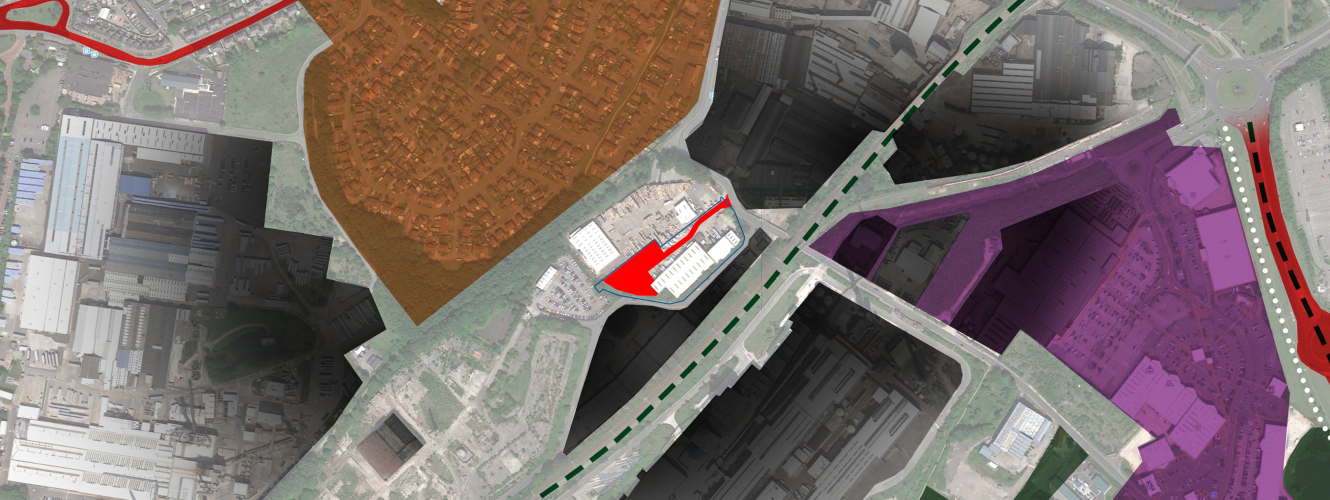

- The client instructed Fisher German to undertake due diligence and complete a valuation of their interest in a 0.56 acre brownfield site in St Helens.

- The site benefitted from planning permission for a mains gas driven 20MW export capacity gas ‘peaking plant’.

- The plant was mid-construction and the valuation was required for funding purposes to support their development.

Solution

- Fisher German reviewed the history of the site and background of the development to fully understand the project motives.

- Detailed sensitivity analysis and financial modelling were completed based on projected market conditions and risks.

- Regular communication with the client ensured the site was valued subject to a number of key assumptions required to satisfy the funder.

- The site was ultimately valued in excess of £20M.

Benefits

- The client was able to satisfy their funder utilising the detailed valuation report and progress the construction of the plant.

- The plant is forecast to come online in 2021.

- The gas peaking plant will provide reactive power to the National Grid at times of need, helping the UK transition from fossil fuel generation to more renewable energy schemes, making the electricity network more sustainable.

- Richard Meakin, Director of Terra Firma Energy Ltd said: “We have worked with Fisher German on a number of energy projects now and found their knowledge and experience of the industry vital in meeting tight funder deadlines”.