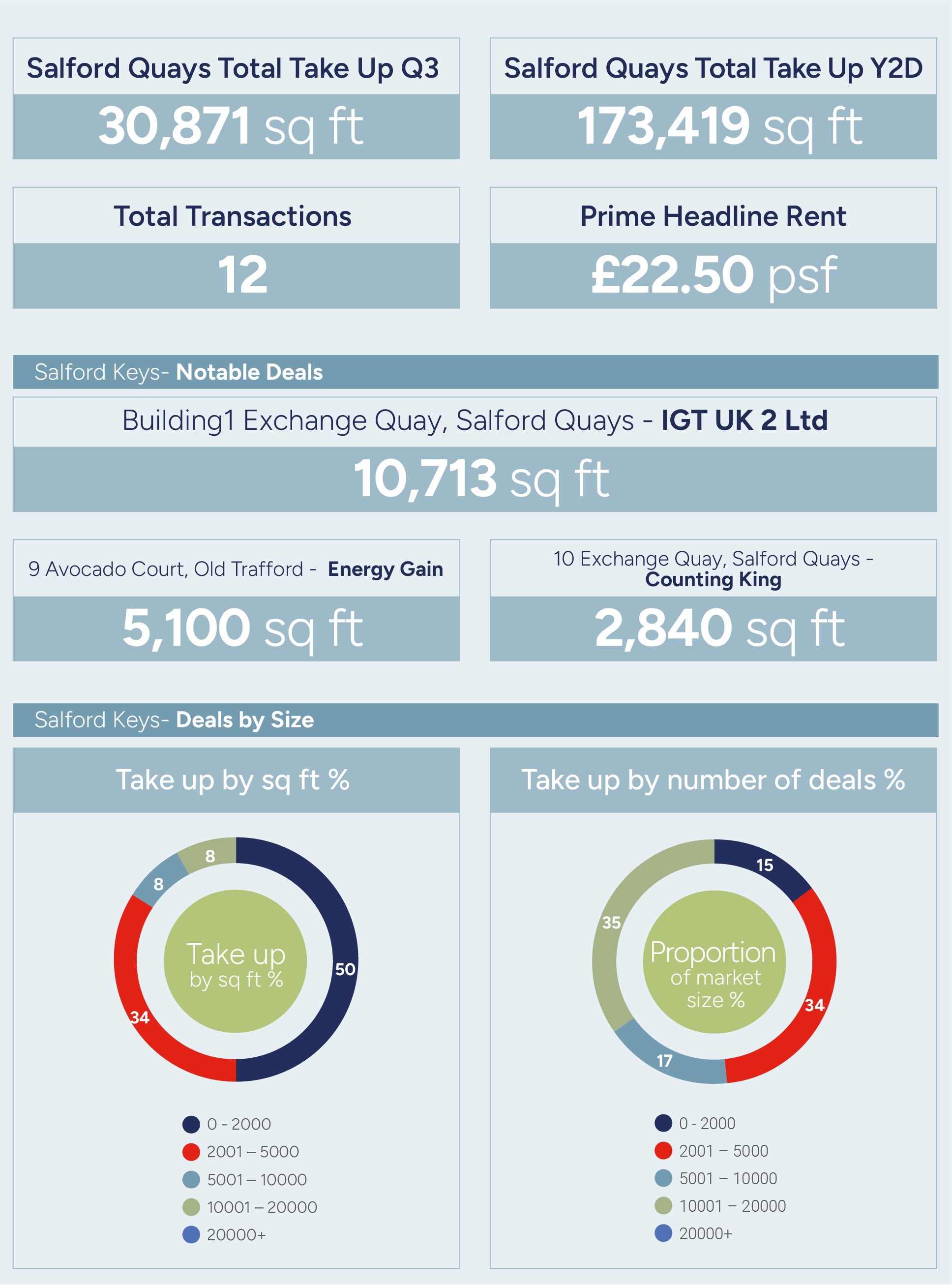

The take up figures for Q3, were significantly lower than the previous quarter, recording only 30,871 sq ft.

Many companies are still tackling strong economic headwinds which could account for this figure. Salford Quays and the surrounding areas are a vibrant and successful submarket that consistently out performs established regional city markets.

As an office market, it is increasingly under supplied in terms of modern Grade A office accommodation - as many older buildings have been redeveloped for residential uses, and new building developments are challenging - especially when current market conditions are considered, ie high build cost, increased financing costs and changes in occupier working practices.

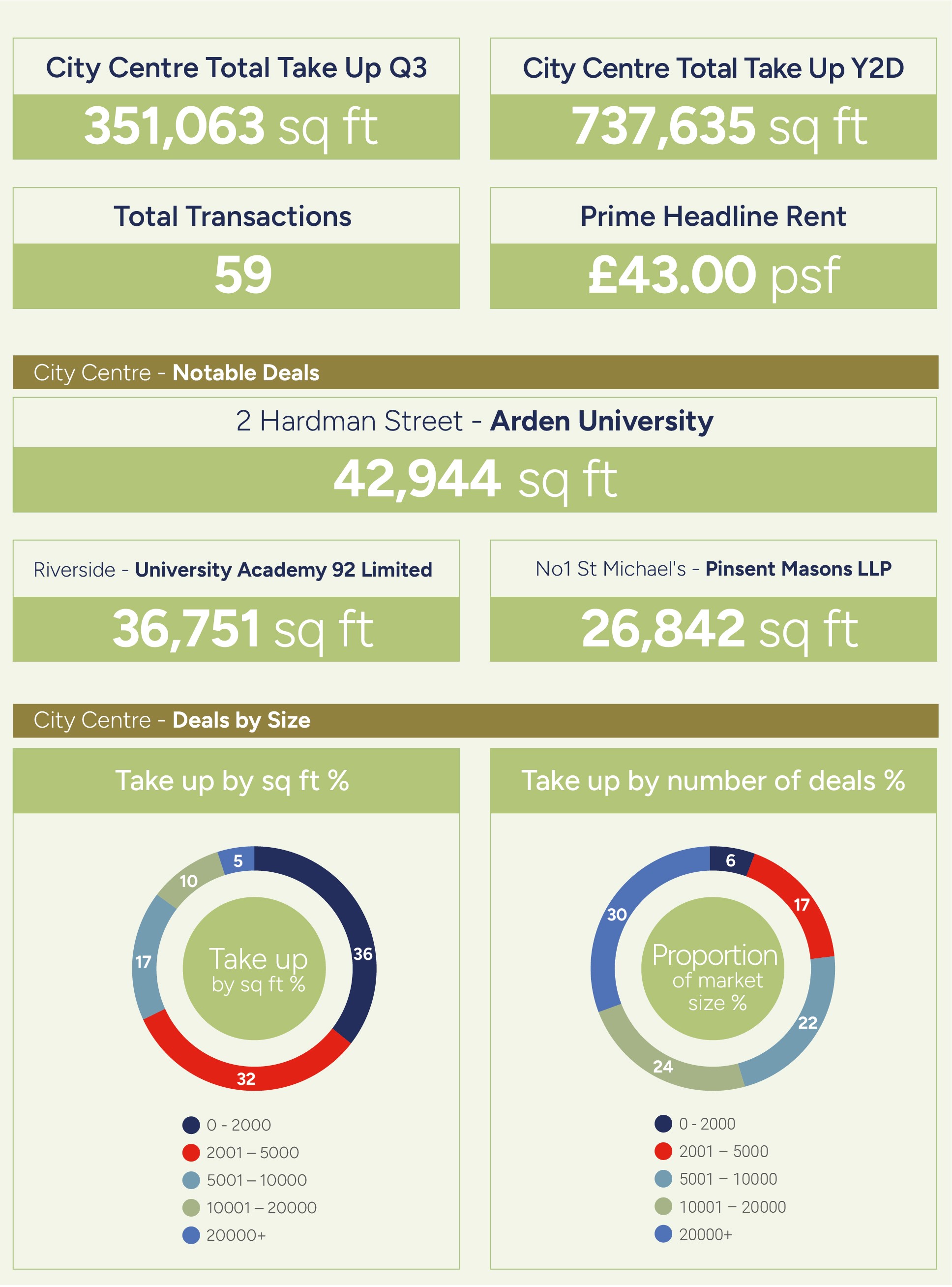

Grade A office space in Manchester city centre continue to be taken, especially as the supply of quality accommodation is diminishing in the city centre.

The take up for Q3 totalled 351,000 sq ft which was 172,000 sq ft more than the previous quarter. Q3 has also seen Manchester achieve record headline rents of £43.00 psf - agreed at No.1 St Michael’s with pre-lets to Pinsent Mason and Hill Dickinson.

There is an expectation that this level of activity will continue into Q4 – if so, Manchester could exceed the 1m sq ft this year.

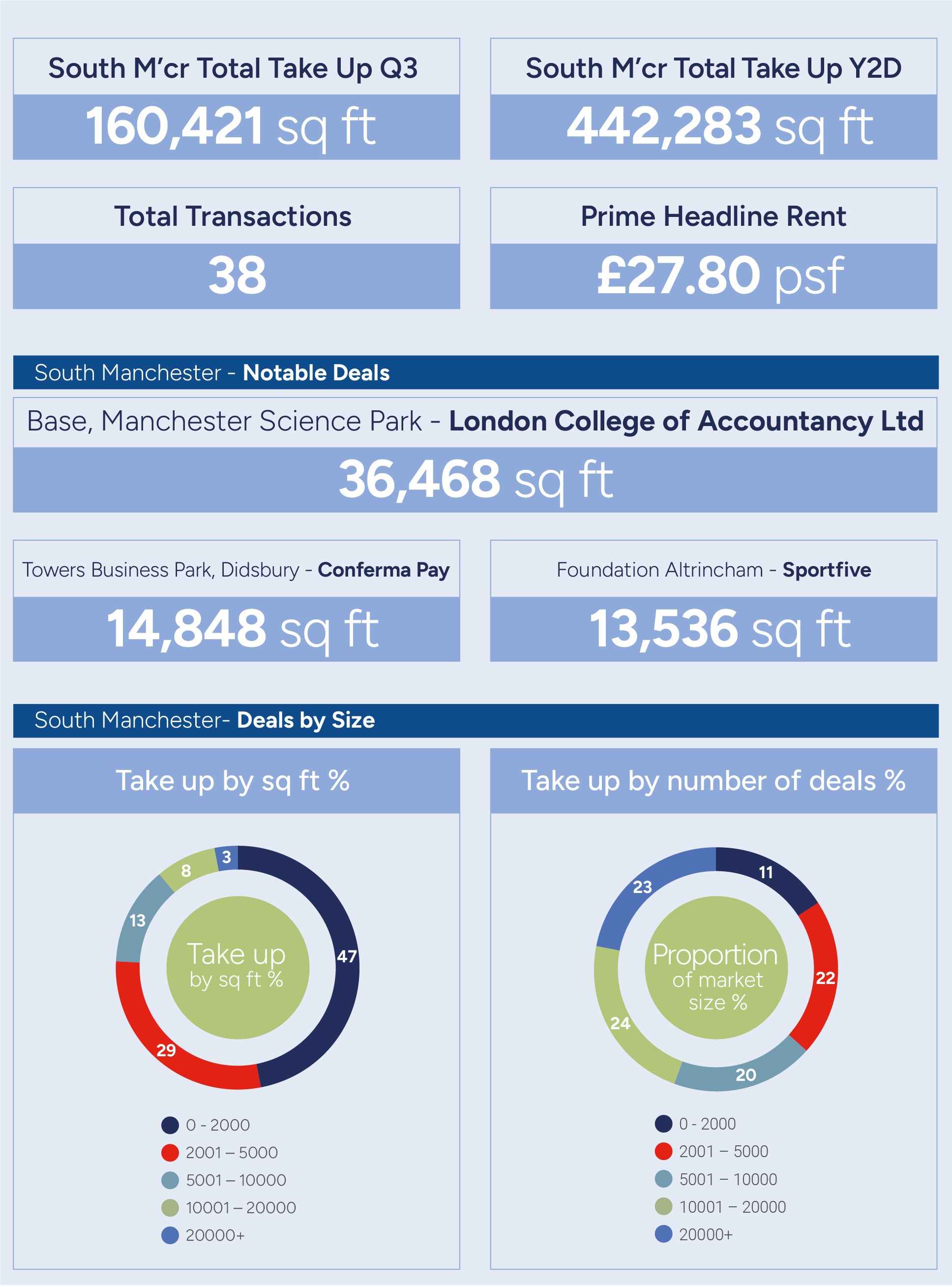

South Manchester witnessed an increase to 160,421sq ft in Q3, compared to 146,806 sq ft in Q2.

The increase in the amount of space let has been driven by:

- The appeal of town centre locations

- Out of town office locations offer occupiers quality accommodation, enhanced amenities and a vibrant working environment for employees