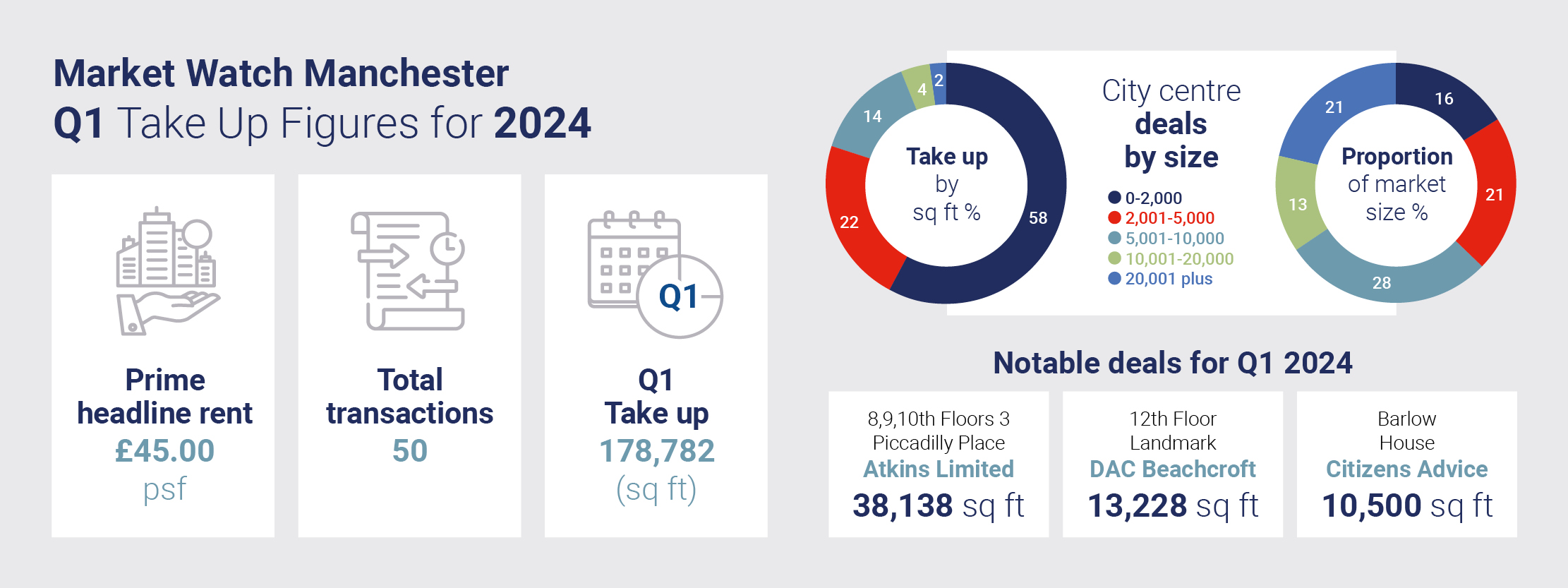

Manchester City Centre

173,000 sq ft of office space was let in Q1 this year in a total of 50 transactions compared to the 205,000 sq ft in the corresponding quarter last year.

“Notwithstanding the slight reduction year on year the consensus is that the rest of the year remains positive and bright for the Manchester office market. The overriding observation is that the flight to quality show no sign of slowing and there is a strong pipeline of transactions waiting to complete”.

The largest deal of the Q1 was Atkins’ taking 38,000 sq ft at Longmead’s 3 Piccadilly Place followed by DAC Beachcroft committing to 13,228 sq ft on the 12th Floor at Landmark.

“Despite the general economic situation, the Manchester office market continues to demonstrate resilience in comparison to other regional areas”.

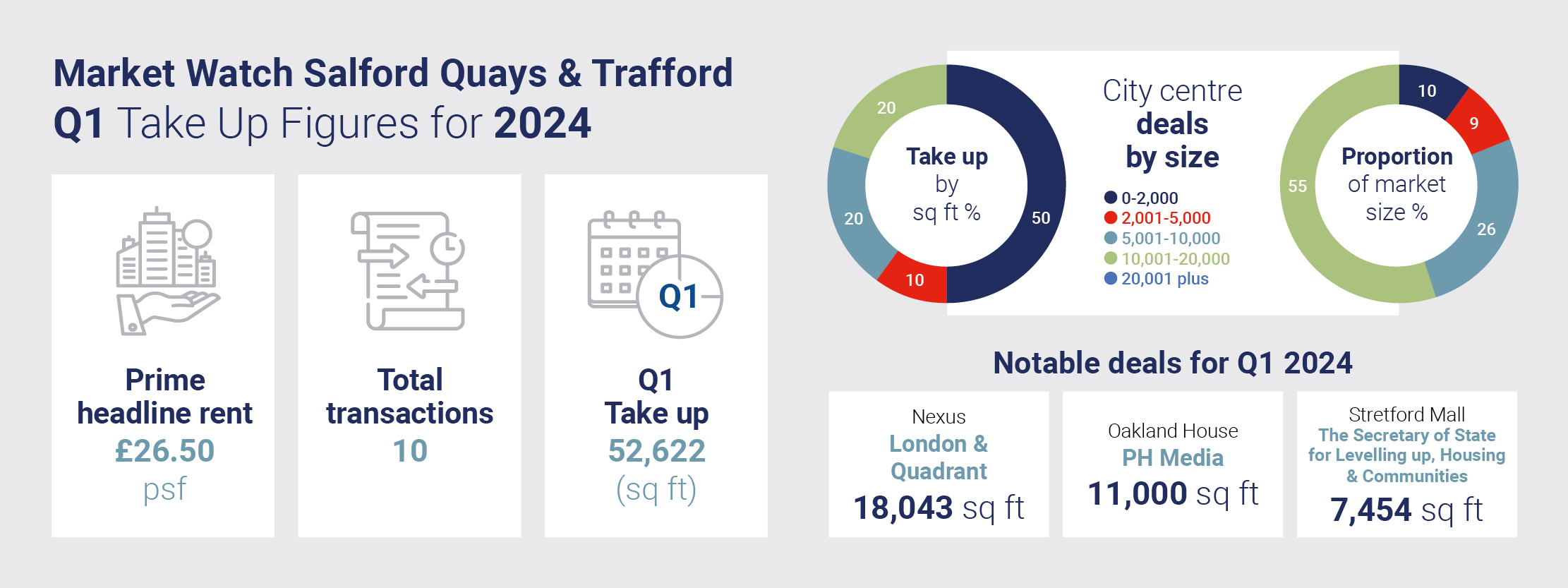

Salford Quays & Trafford

Salford Quays and South Manchester witnessed a combined take up of office space of 52,600 sq ft across 10 deals in Q1 compared to 44,780 in Q4 2023 showing an 18% increase.

The largest transactions of the quarter were L&Q taking 18,000 sq ft at Nexus and PH Media committing to 11,000 sq at Oaklands House in Old Trafford.

“The start of the year has been relatively subdued in terms of number of deals transacted but the market in Salford Quays and Trafford remains healthy”.

South Manchester

92,476 sq ft of offices was transacted across South Manchester in Q1 in 60 deals compared to 135,056 sq ft in 84 deals in Q1 last year. The largest deal of the quarter being OFGL committing to 12,000 ay Solutions House in Stockport and Bulme Group leasing 10,500 sq ft at Egerton House.